I welcome you, guests of the BIZOOMIE portal! Once again, Pavel Sergeev is with you, and today's article will be devoted to the question of how to withdraw money from webmoney. This century information technologies and Internet commerce, a significant part of financial transactions is carried out using electronic payment systems. There are a great many of them, and Webmoney is considered one of the most reliable from the point of view of security of conducting money transactions and protecting accounts and user data. For this reason, unprecedented reliability, most organizations and ordinary users prefer to use the services of this service.

The negative side is the difficulty of using this payment system. Users, especially beginners, often have difficulties in the process of mastering the service. In fact, the webmoney interface is not built in the most friendly way, and it is often completely unclear how to perform the operation you need or even get to it. It is also necessary to take into account the peculiarities of charging commissions and insurance fees, which are not always 100% understandable, and instead of the expected amount, you can get a little less.

The situation was even more complicated in early 2016, when the Central Bank arranged an audit of banks, and transfers to their cards from a number of electronic payment systems were suspended. Prior to this, the procedure was relatively simple, and money came quickly to the bank card tied to the wallet, without problems and with an acceptable commission, which fluctuated depending on the conditions of the bank.

Now the withdrawal of WebMoney electronic funds occurs mainly through exchange exchanges, which is, on the one hand, a positive change, and on the other hand, it is not entirely convenient and not always profitable.

A characteristic feature of all methods of withdrawing money from WebMoney is the need to pay commission fees. This feature, in general, is inherent in all, without exception, operations related to the transfer of money and their cashing out. As a result, you get a little less money. And the larger amounts you need to withdraw, the more money you will lose on this. Therefore, to save them, it is important to find the most inexpensive way to withdraw money from webmoney.

The second feature is that money transfer will not always be carried out instantly, as we would like, or as soon as possible. If you need to make an operation on an urgent basis, you will have to pay a commission several times the cost in the usual way of withdrawing money. This usually takes one to three days.

Webmoney can be used for electronic money - you can make purchases via the Internet, pay for mobile communications, the Internet and more. This is the best option, in which everything happens quickly, and you do not lose a penny. It is also possible to transfer money to the wallet of another electronic payment system, instantly and with a minimum commission. But this does not solve the issue of cashing them out. Transferring virtual rubles or dollars into real ones that can be spent on anything is of primary interest to those people who make money on the Internet. On the question of how to cash webmoney, we will dwell in more detail.

How to earn webmoney is a separate topic that has already been repeatedly analyzed on the portal, including specific methods of generating income on the Internet. If you are interested, I recommend that you read one of these articles:

How to withdraw money with Webmoney - ways!

So, the money earned, or received in any other way, is available on the electronic WebMoney wallet. The most popular denominations for calculations are WMR and WMZ, that is, Russian rubles and US dollars in electronic form. There are practically no differences in how to withdraw them, unless you have to convert dollars at the current rate of the payment system, if you need rubles in the end.

Also, in the conditions of money withdrawal, the commission of the webmoney system itself for transferring money is not always indicated, so another 0.8% must be added to all the indicated percentages. But when conducting any exchange or cash out transaction within the framework of the webmoney system, you can be absolutely calm that you will not run into fraud.

How to cash webmoney instantly?

How to withdraw money through Webmoney terminal?

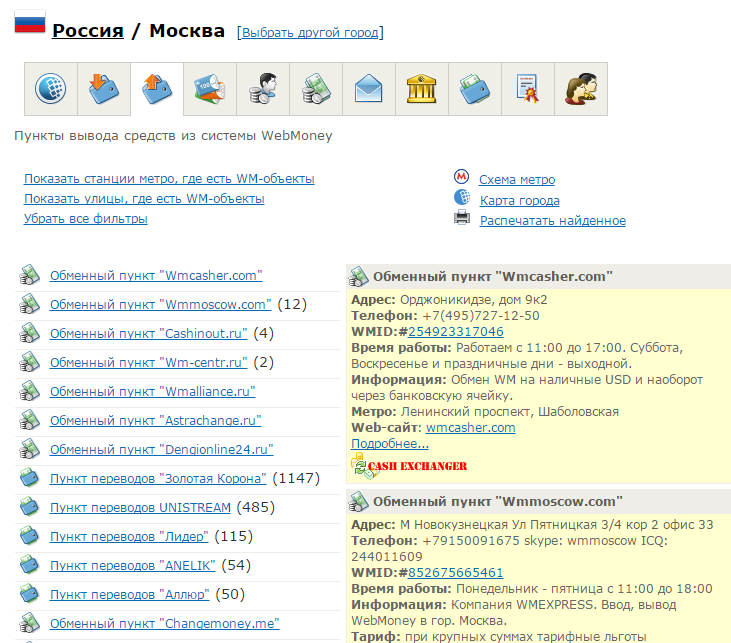

Receiving funds through a terminal or dealer service office is the fastest option on how to withdraw money from webmoney. In addition, one of the cheapest. In this way, you can withdraw absolutely any virtual currency of this payment system.

The fee will be at least one percent of the cashable amount. As a rule, dealers usually take more; there are no official upper limits. Within reasonable limits, naturally. In any case, this is also the easiest option.

However, there are a number of nuances that will not allow everyone to use this method. The fact is that there are by no means representative offices and WebMoney terminals in all, even relatively large cities. Either there is a point at a considerable distance from you, and what is the point of traveling through the whole city if you spend more on travel than save on a small commission.

How to instantly withdraw webmoney to a card?

Unlike the first option, this one - send webmoney to a card via phone - will suit everyone who has a mobile phone and a VISA or MasterCard. Its advantage is speed. It will take two stages of action and a series of operations. As a rule, the possibility of withdrawing money from the balance of the phone is provided for all operators mobile communications. As well as payment of a number of payments and services from your personal account. Now in the webmoney system there is no way to instantly withdraw money directly to your card.

Replenish your account first mobile phone from your webmoney wallet. Money is credited instantly. Next, go to your operator’s personal account and transfer funds to your bank card. In this case, you pay a commission of 0.8% WebMoney payment system and a commission to your operator. The lowest commission for MTS - from 4% of the amount, the highest - for Megaphone - from 6%. If you need money urgently, with a loss of at least 40-60 rubles from every thousand you have to reconcile.

If you believe the information indicated officially, funds can be transferred up to several days, as with a bank transfer. But personally, I use MTS, and money always came to my card instantly, never delayed. I can not vouch for other operators, check it yourself! This is the fastest, but expensive opportunity to withdraw webmoney to the card of any bank.

Please note that debit cards of some banks may not be supported by a particular operator and money transfer to them is not possible. Information about this will be indicated in the application process. Also, operators have restrictions on the number and maximum amounts that can be withdrawn from the personal account in one day.

How to withdraw webmoney to a card with a minimum commission?

Where to get money to start your own business? It is this problem that 95% of beginning entrepreneurs face! In the article, we revealed the most relevant ways to get start-up capital for an entrepreneur. We also recommend that you carefully study the results of our experiment in exchange earnings:

The best options, when using which you will pay the minimum commission for withdrawing money to the payment system, are transferring WMR or WMZ to a card or bank account, or mail order through one of the available money transfer services.

In order to withdraw webmoney to a card, the Cards Exchanger exchange service is directly provided, the commission of which is 2% of the amount. This service is offered only to users with a certificate of no lower than initial with confirmed data who are citizens of the Russian Federation. The card must also belong to one of the Russian banks.

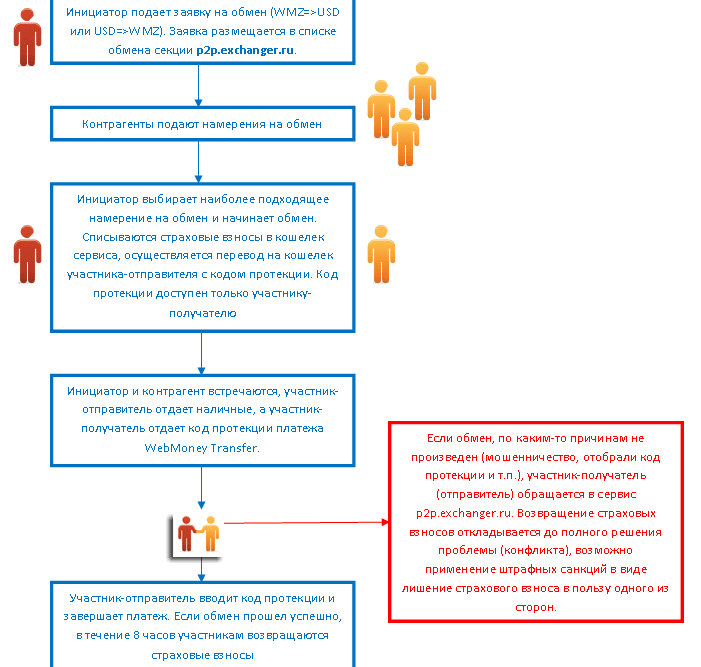

Feature this method, how to withdraw money from webmoney, is that your application should interest the counterpart, another participant webmoney systems, which will make the exchange and credit the money to your account. This is not guaranteed, and if the response from the counterparty to your request does not follow in a timely manner, the application will be canceled and will have to be submitted again. If you cancel the application yourself earlier, the money will be returned to you, but minus the commission.

You set the validity period yourself, at least 3 days. With a successful response to the application, you receive money within 5 days from the date of confirmation. The maximum amount is 35,000 rubles per day, the minimum is 100 rubles.

The service is currently undergoing a testing phase, has no direct links from the interface of the webmoney payment system and is available at: c2c.web.money. Another feature - money can come to your card in parts, with an interval of several hours or days. If the total amount is not transferred to the card to you, the balance will be returned back to the wallet.

Ways to withdraw to a bank card WMR, WMZ, WME

The previous way to withdraw webmoney to a card is available only for Russian rubles. If you need to receive dollars or euros from the corresponding webmoney wallets, the Telepay service will help you. The terms for crediting money by this method do not exceed three days, there is no likelihood of canceling the application, it is accepted for execution guaranteed. However, you will have to overpay for this.

The withdrawal per day for WMR is limited to 35,000 rubles, a minimum of 100 rubles; commission - 2.5% + 40 rubles. WMZ can be withdrawn in the amount of 10 to 500 dollars per day, commission - 2% + 3 US dollars. WME withdrawal conditions - 10 - 500 euros per day, commission - 2% + 3 euros.

WMR withdrawal by postal order

This method, how to withdraw money from webmoney without opening a bank account, is possible only in rubles and from WMR electronic wallets. The transfer is carried out through the Russian Post, the commission is 2%, but not less than 60 rubles. Dates of receipt - up to 5 days. The maximum amount that you can withdraw in this way is 5000 rubles.

Money transfer is possible only on the passport data of the sender, the holder of the wallet. Do not forget to check them during the application process, if upon receipt they do not correspond to the data in your passport, they will refuse to pay you.

Withdraw WMR and WMZ money transfer

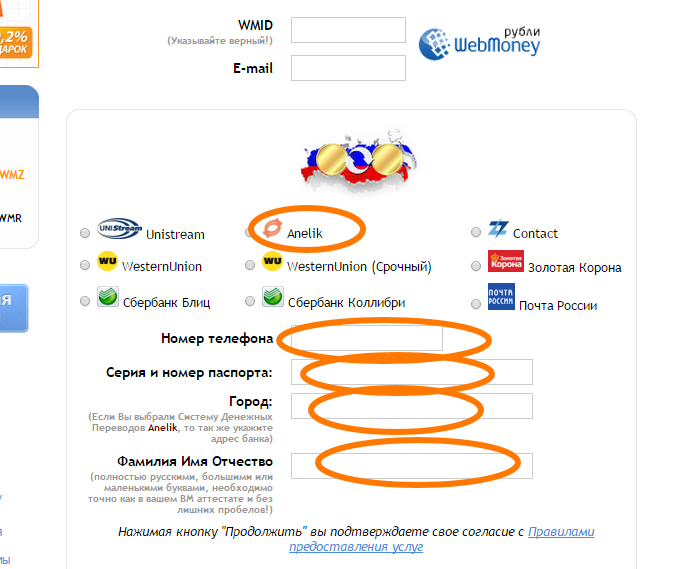

For ruble and dollar webmoney wallets money withdrawal is available through money transfer systems: Contact, WesternUnion, UniStream and Anelik. Features of this method: certificate no lower than formal, you must provide a copy of your passport - upload to Webmoney server; transfer in rubles is possible only on the territory of the Russian Federation.

Sending money is also possible only on the data of the owner of the wallet. When drawing up the application, you choose the preferred exchange rate option from the number of existing and presented to choose from, or create your own on your terms. As a result, the commission fee will vary from 0.5% to 3-4% and higher depending on the amount of transfer and the counterparty’s terms. After the appearance of a counter response, money can be received at the money transfer service department in 30 minutes, the maximum period is 24 hours.

When drawing up the application, you need to independently choose the address of the desired item, in which you will receive your money. Offices and service points are present in any city, there should not be any problems with their search. This option, how to withdraw money from webmoney, is also convenient because there is no need to have a bank account, as well as the ability to transfer large amounts up to 60,000 rubles per day and up to 200,000 rubles per month. To ensure a guarantee of fulfillment of obligations on the application, you will be deducted from the amount of 2% of the transfer amount, which will be returned after the successful completion of the money exchange.

How to withdraw money from webmoney to a bank account?

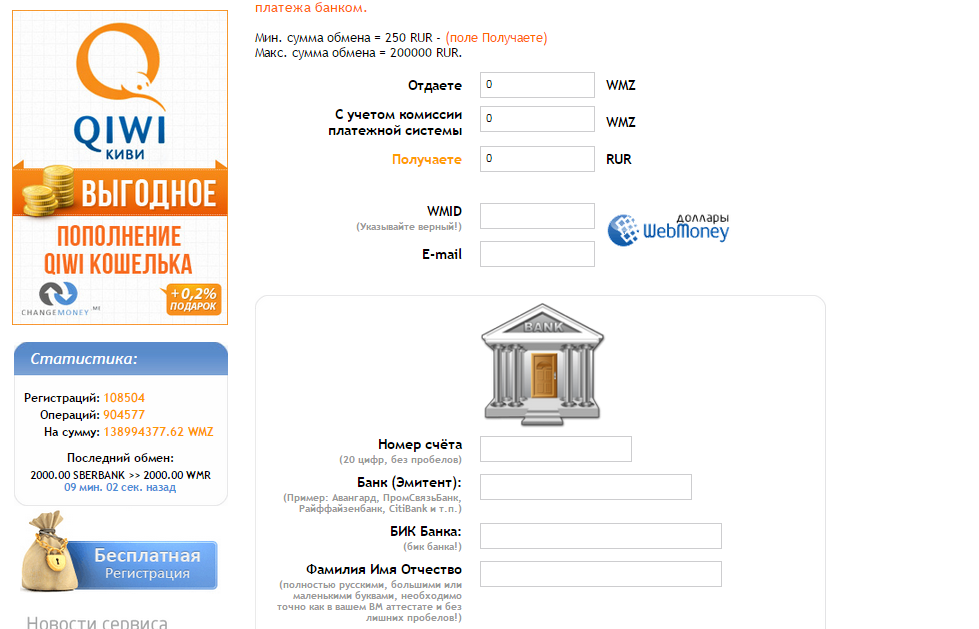

This method of cashing money with webmoney is similar to a money transfer. You can send funds only to your personal account in any bank in the world. The exchange is made through the wire.exchanger.ru exchange, where you can choose an offer from the available ones, or place your request. You can exchange any electronic money WebMoney system, including each other, without withdrawal.

This method of cashing money with webmoney is similar to a money transfer. You can send funds only to your personal account in any bank in the world. The exchange is made through the wire.exchanger.ru exchange, where you can choose an offer from the available ones, or place your request. You can exchange any electronic money WebMoney system, including each other, without withdrawal.

This method, how to cash webmoney, involves the presence of an amount of at least 5000 rubles, 1000 dollars or 1000 euros. Second, if you create an application on terms favorable to you, this does not mean that it will interest the counterparty. Or he will have to wait days and weeks. Often this fact forces you to cede and increase the percentage of remuneration, after which the application is immediately taken into production. Here, in contrast to the above method of withdrawing money to a card through exchange on the exchange, an application can be deleted without consequences until a counter has appeared, and create a new one. Nevertheless, the exchange provides an opportunity to make a withdrawal of funds on fairly favorable terms in comparison with other methods.

When applying, you are also frozen two percent of the amount of the transfer as insurance to fulfill obligations. After successful completion of the exchange and the arrival of money, you need to confirm this and close the application. After which the insurance premium will be returned to your wallet. Money comes to your account within three banking days.

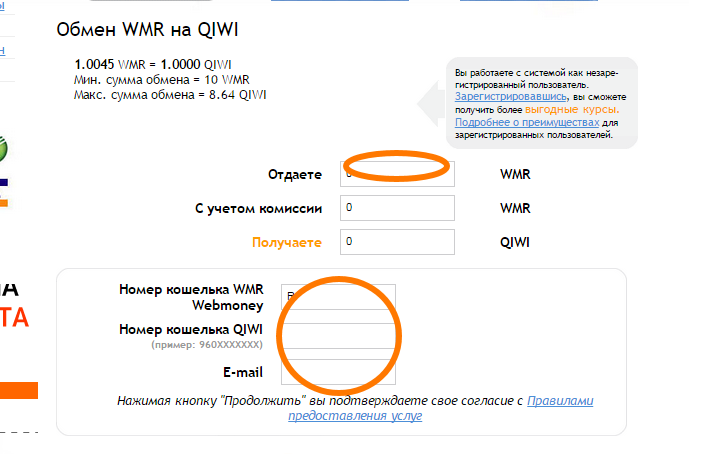

How to exchange webmoney for electronic money of another payment system?

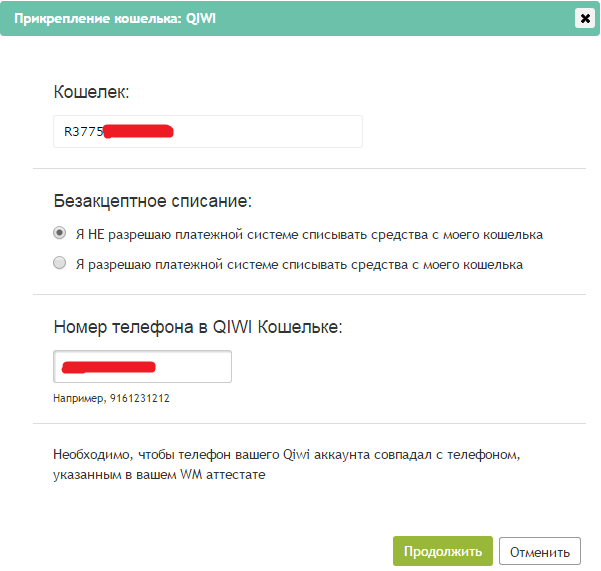

This feature is of particular interest if the user often requires virtual money from another payment system to calculate. Or it’s easier and more profitable to cash out than webmoney. For this purpose, the interface provides the ability to bind a wallet, for example, QIWI.

Conclusion

Working with electronic payment systems takes time to master the nuances, which are no less here than in the changing rates of real currencies. Nevertheless, if you often deal with such calculations via the Internet, you will have to master this area and work out the best way for you to withdraw money from webmoney.

Webmoney, although it is quite complicated to use a payment system, it also remains one of the most secure, reliable and in demand.

I wish you to withdraw more real money from WebMoney virtual wallets!

When Webmoney is earned, a logical question arises: how to cash them out? Consider the most common ways to cash Webmoney in the realities of Russia. This article will discuss the withdrawal of Webmoney in cash, and here we will consider the withdrawal of Webmoney to other payment systems. Immediately make a reservation that most methods require the presence of at least a formal certificate. So, the main ways to withdraw Webmoney:

Cash withdrawal

In this context, withdrawing Webmoney in cash means transferring to another participant in the system and further receiving cash from him in person. There are 3 possible options:

- Through an official partner of the system ()

- Through the exchange service between system participants ()

- With the help of friends and acquaintances having a reverse need

This method is good in large cities where there are partners of the system and other participants.

ATM cash withdrawal

The question itself implies the presence of bank card. And here we have 2 options:

- Get a Webmoney Card;

- Link your bank card to the wallet

Via bank transfer

With this method of cashing, the money will first go to your bank account, from where you can withdraw it in cash in any convenient way. A formal certificate and above is required for translation. , there you can send WM mail order.

In addition to direct withdrawal, there is also a specialized exchange section in the Excanger service, where you can also exchange Webmoney for bank transfer with another member of the system. .

Postal transfer

You can cash Webmoney using a mail order. you can cash Webmoney even where there are no ATMs, but there is a Russian Post office.

Money transfer systems

One more alternative way Webmoney cashing out - through money transfer systems.

- Anelik

- Unistream;

- Contact;

- Leader;

- Gold Crown

You can use Webmoney output through the system data using the service.

In addition, there is a specialized service in the Exchanger service where you can exchange Webmoney for transfer in one of the listed systems, as well as others, for example Western Union.

other methods

If you want to clarify the actual withdrawal methods or tariffs, then detailed information can also be obtained.

Users of the international payment system WebMoney often face the issue of withdrawing their own funds. Also, very often owners of WM-currencies are faced with the problem of choosing a withdrawal method, since there are a lot of the latter. All of them function on different conditions. In this regard, it will be appropriate for you to learn about all the existing ways of withdrawing funds from the WebMoney system, as well as the conditions of each of them. The article will help in choosing a quick, profitable and convenient way to withdraw funds from WM-wallet.

How to withdraw money from WebMoney

A list of all existing methods of withdrawing funds can be found on the official website of the system in the "Help" section. On the given time WebMoney (hereinafter - WM) offers such methods of withdrawing funds:

- receive cash in cash at exchange points or from WM dealers;

- transfer the required amount to a bank or card account attached to the wallet;

- save money on a WM card ordered through the service;

- withdraw funds to a virtual card, which can be used to pay online (you can also issue such a card through the WM system);

- transfer money using the Internet banking system partner banks;

- execute a money transfer using cash payment systems;

- use a bank transfer;

- exchange funds from WebMoney to electronic money;

- cash out via postal order;

- use the exchanger.ru exchange, which allows you to withdraw funds in cash and provides other types of exchange;

- return the funds from storage at the Guarantor (a participant in the system that stores the funds and ensures their withdrawal on behalf of WM);

- receive cash in the office of a bank or system partner;

- funds can also be transferred to another WM-wallet or exchanged for another currency;

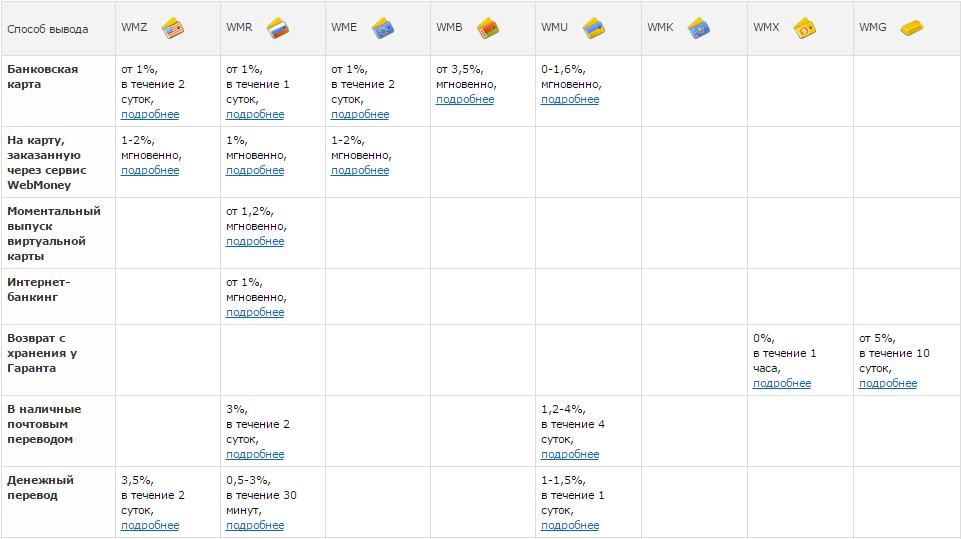

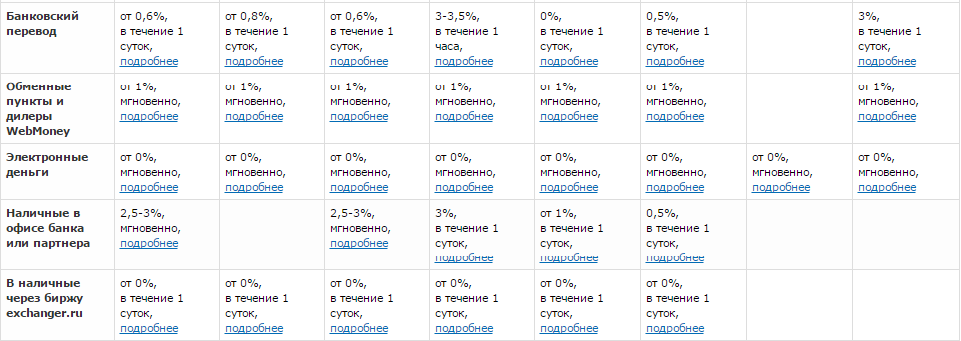

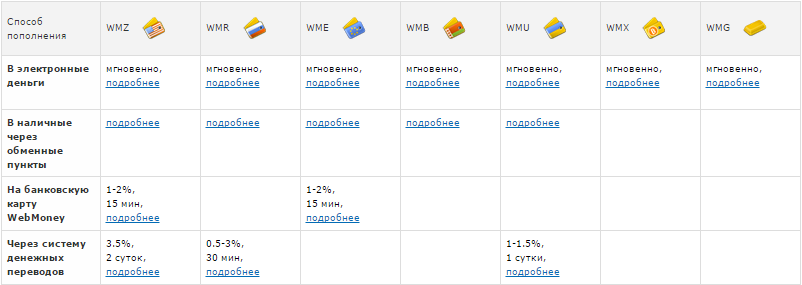

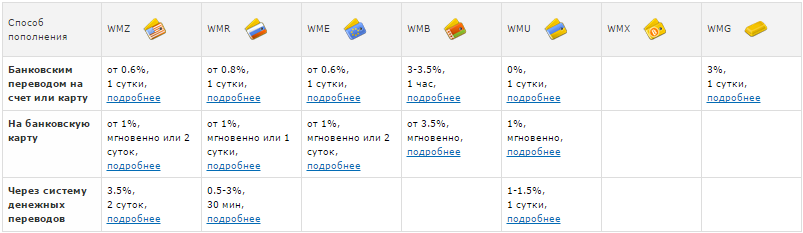

A feature of these methods is that not all of them are used for each of WM-currencies. That is, a separate method is possible only for a certain currency. So, for example, users of the system can only return WMX currencies (par value of rights to publish entries in the bitcoin.org database) and WMG (gold par value) from the Guarantor’s storage. All features can be found in the table below.

In addition, the system of methods for withdrawing funds from WM can be divided into three separate groups, which will greatly help users make their choice. So, all methods are divided into:

- comfortable;

- fast

- profitable.

Convenient paths are designed to facilitate the withdrawal process for users. They are aimed at ensuring that citizens can exchange funds at home without getting up from a computer desk. These methods include:

When you need to get money urgently, users are advised to use quick ways withdrawal of funds. With their help, funds can be received on hand in just a few minutes after the transfer from the wallet. They are also provided in a separate table.

.

In turn, profitable methods will come in handy for those who want to get their money with the least losses. In this case, the user does not have a question of complexity. The following output methods correspond to this criterion:

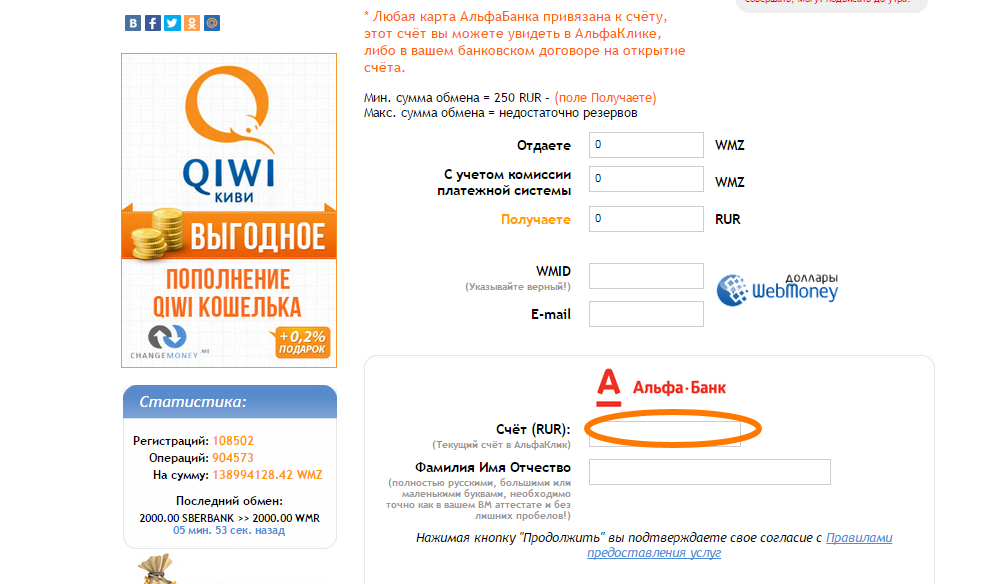

The procedure and conditions for withdrawing money from Webmoney to a bank card

As shown in the table, withdrawing money to a card from the Webmoney system is possible only for the following five WM-currencies:

- WMZ (equivalent –USD);

- WMR (equiv. - national currency of the Russian Federation);

- WME (eq. - Euro);

- WMU (equiv. - national currency of Ukraine);

- WMB (equivalent - the national currency of Belarus).

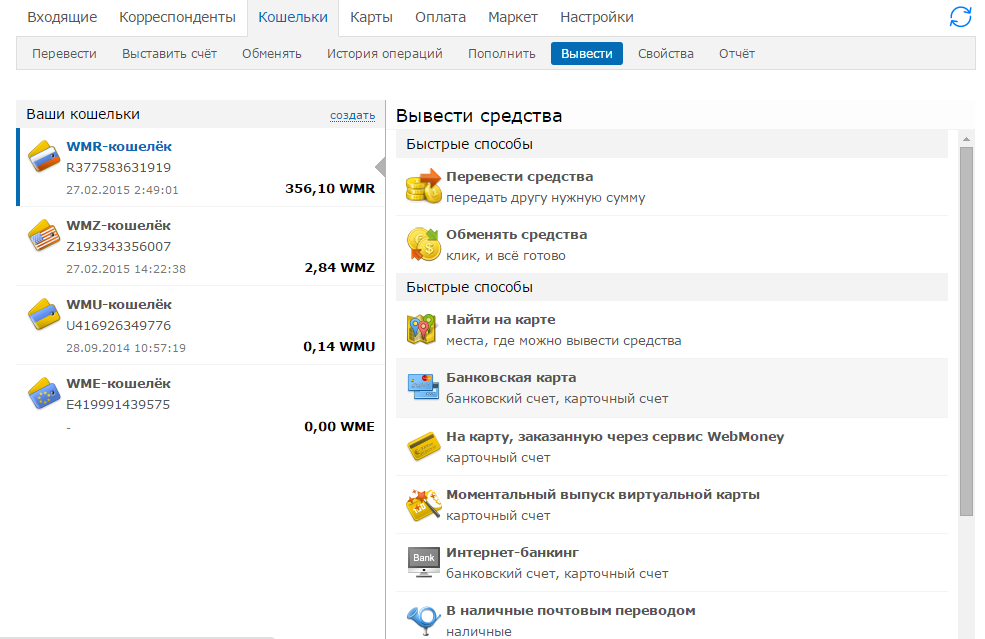

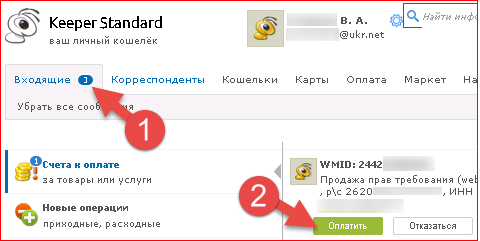

In order to withdraw money to a bank card, you must perform the following steps:

7. After payment, the funds will be credited to the card within the period specified in the conditions of the withdrawal method. Will also be charged installed by system commission.

It is very important to know that it is possible to withdraw funds in this way only if there is a card attached to the wallet. If the card has not been previously attached, then the user will need to additionally carry out this procedure, and only then can he transfer the funds.

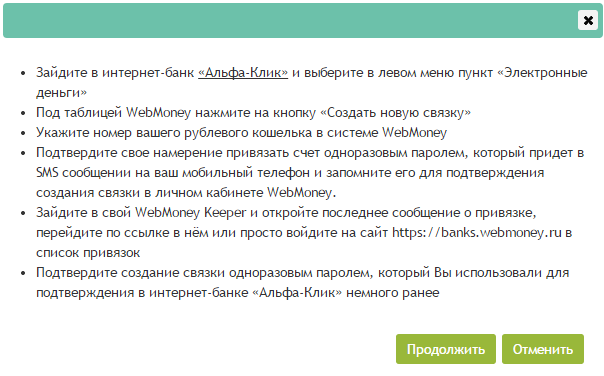

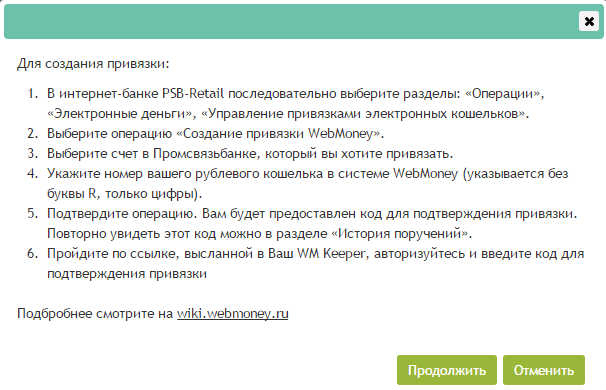

In order to attach a card it is necessary:

- follow paragraphs 1, 2 of this instruction;

- the site will automatically redirect to the map attachment page;

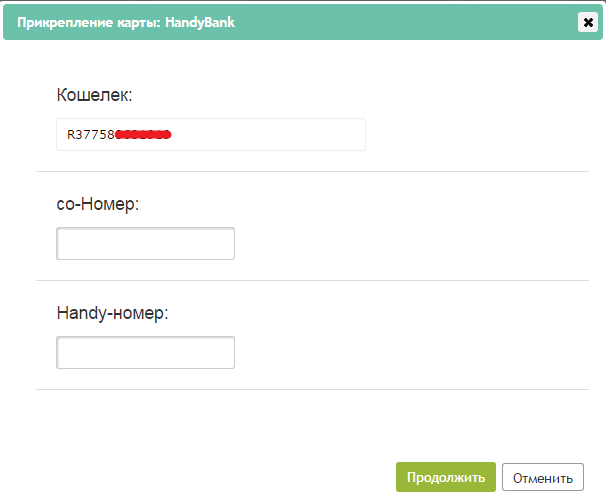

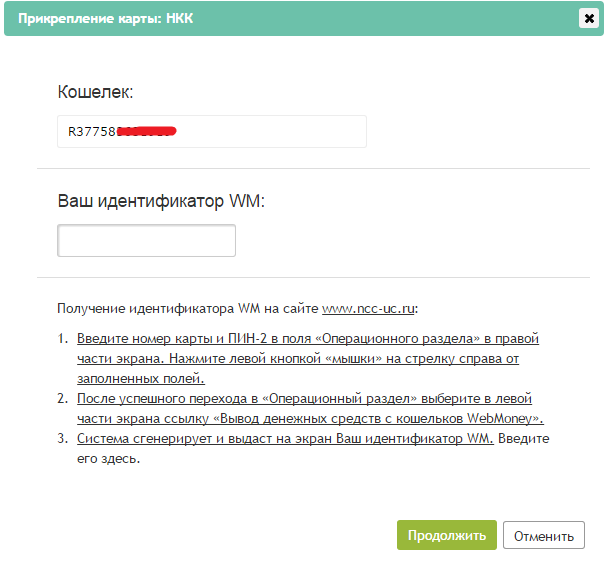

- on the page, select from the provided list the partner bank whose card you want to withdraw money to;

- enter the card details on the website of the partner bank.

After that, the bank will independently verify the information on the card holder. If the bank confirms the data, the card will appear in the list of card accounts attached to the wallet.

Russian partner banks of the system are:

- alfa-click Internet Bank (withdraws Webmoney Alfa-Bank);

- Ocean Bank;

- "WM-Card.com";

- “HandyBank”;

- "NCC";

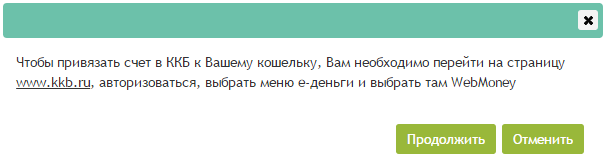

- Conservative Commercial Bank; (the card is attached to Webmoney by OJSC KKB Bank only on its official website);

- "PromSvyazBank".

How to withdraw money from WebMoney to an electronic wallet

A feature of the withdrawal of WM-funds into electronic money is that such an exchange is possible for all eight types of WM-currency and it is carried out instantly.

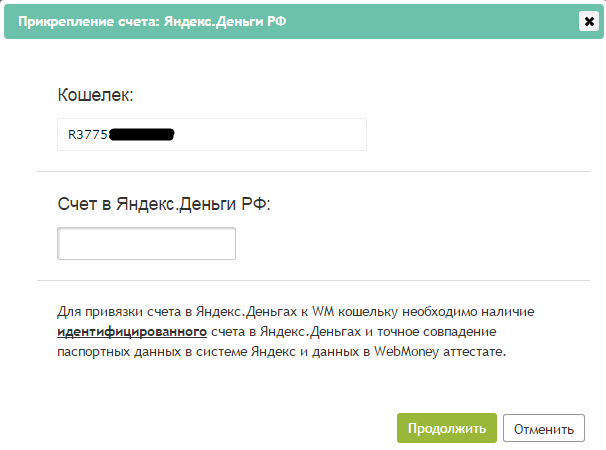

The withdrawal of funds in this way is possible on the accounts of the following electronic payment systems:

- Yandex money;

- Easy Pay (accepts only WMB wallets).

The translation in this way will look like this:

- In the menu of choosing withdrawal methods, indicate the option "Electronic money".

- Choose from the list of accounts attached to the wallet the one to which the funds will be transferred.

- Enter the transfer amount and other necessary data in the appropriate field.

- Check the correctness of the entered data and perform the operation.

- After that, the money is instantly credited to the account.

In order to use the specified method (for example, withdraw Yandex.Money to WebMoney), again, you need to bind the account of the above systems to the WM-wallet. The procedure for performing such actions for each of them is given below.

Ways to transfer money from Webmoney to cash

The question of how to withdraw money via WebMoney to cash is one of the most relevant among users of the system. There are several ways to exchange WM-funds and these include:

- receiving money at exchange points or from WebMoney dealers;

- execution of a postal order;

- cash withdrawal via money transfer;

- use of the exchange exchanger.ru.

Everyone who has money on a WebMoney wallet can apply for receiving their funds at specialized WebMoney points or to system dealers. Find out the location of such institutions in any city as follows:

- among the list of output methods, select the option called “Find on the map”;

- on the page that appears, in the search bar, enter the city in which you want to receive cash;

- perform a search;

- the system will display the addresses of all points in the specified city;

- the user will only have to select the appropriate item and go there with a passport.

To withdraw funds by post transfer:

- Choose the “Cash in by postal order” method.

- Fill in the payment details on the corresponding page, where to indicate personal and address data, as well as the amount to be transferred.

- Then confirm the agreement with the terms of the transfer.

- Complete the operation.

By this method, the Russian Post provides for special limits on the amount of withdrawal of funds per day and per month. So, the following restrictions are set:

As for the money transfer, its execution is possible using the following systems for cash payments:

- "CONTACT";

- UniStream;

- "NPO" PSA "";

- Anelik

- "Gold Crown".

To carry out such an operation, it is necessary:

- As usual, select a method called “Money Transfer” from the list.

- Then choose the right system for paying money.

- Fill in all the necessary data.

- Check the input is correct.

- Confirm the operation.

On the exchanger.ru exchange, users can apply for the withdrawal of their funds. You can also use it by going to the menu of output methods. The exchange of money for cash in the system is as follows:

- WebMoney system developed fast, convenient and profitable ways to withdraw funds. Decide what is more important for you - time, money or withdrawal without extra effort. Only after that choose the method of withdrawing your own money that is suitable for you.

- Before using a specific withdrawal method, carefully read all of its conditions.

- When withdrawing, always check the correctness of the entered payment and personal data, regardless of the chosen method.

- Remember that not all methods can be applied to all currencies. Therefore, before withdrawing, find out about the possibility of a particular withdrawal method for your wallet.

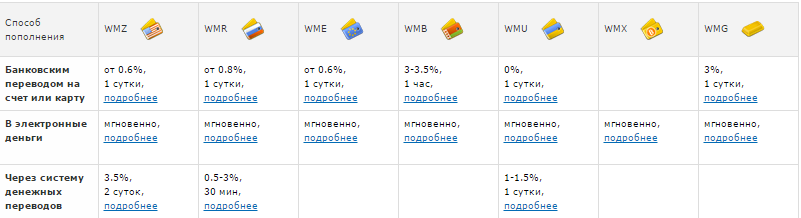

Today Webmoney offers a variety of ways to withdraw money. You can get acquainted with all the methods on the site of the payment system. Among them, the most popular are:

Bank card (commission: from 0%, terms: up to 2 days);

Money transfer (commission: from 0.5%, terms: from 30 minutes to 1 day);

Bank transfer (commission: from 0%, terms: from 1 hour to 1 day);

Instant issuance of a virtual card (commission: from 1.2%, timeline: instantly);

Exchange offices and Webmoney dealers (commission: from 1%, terms: instantly);

A card ordered through the WebMoney service (commission: from 0%, terms: instantly).

To withdraw money from Webmoney, you need to get a formal certificate. This will require scanned copies of the TIN and passport. Only two pages should be scanned from the last document - with registration and with photo. Documents must be uploaded to the Webmoney Certification Center. After checking the information provided by the administrator, the user certificate should be changed to formal.

How to withdraw money from Webmoney to a card or bank account

To replenish Webmoney, you can initially link a card or bank account to an electronic wallet so that transfers are made instantly. This can be done in a number of banks with which the payment system cooperates: Ocean Bank, Alfa Bank, HandyBank, NCC, Conservative Commercial Bank, PromSvyazBank, Otkrytie, BRS.

Using Visa card “WebMoney - Opening”, you can also get additional bonuses when using a card - 1% of card payments are credited back to your wallet. With a MasterCard WebMoney - BRS card, 0.98 WMR is returned to the wallet for every 100 rubles spent on the card.

After the card is tied to the wallet, it will appear in personal account. To withdraw money, you must select the option "Top up card from wallet" and then enter the transfer amount.

For those who do not have a bank card, you can issue a virtual card. This is a full payment card, only without physical media. It allows you to pay for purchases on the Internet and contains all the necessary details for this (account number, card expiration date, verification code CVC2). Order a virtual instant card should be on the site of the payment system.

You can also withdraw money through the Webmoney Banking service. It is necessary to log in to it, then select the "Withdraw" command and fill in the payment details for the transfer.

How to withdraw money from Webmoney through exchange offices and Webmoney dealers

In Webmoney it is possible to withdraw money through a money transfer system. Payment system has been cooperating with the following companies for a long time: CONTACT (commission - 1.5%), UniStream (commission - 1.2-1.3%), NPO SRP (commission - 1.5%), Anelik (commission - 0.3-1.3%), "LEADER "(Commission - 1.5%)," Golden Crown "(commission - 0.33-1%). When receiving money, you must provide a passport.

You can cash electronic money through authorized Webmoney exchange points. Their list varies by region. Get acquainted with complete list exchangers can be found on the Webmoney website. The disadvantage of this withdrawal method is the need to obtain a personal certificate, which is paid and requires the provision of original documents. Another disadvantage is the high commission for receiving money - it can reach 5%.

The issue of transferring money to the world of live currency remains a pressing issue for owners of virtual wallets. There are eight possible ways to remove a VM. Consider the most popular ways to withdraw money from WebMoney: what, how, where, how much.

Webmoney withdrawal to Visa and MasterCard

How to withdraw money from WebMoney to a bank account

So, a window with a form will open. The account number can be seen in the service contract, look in your online account on the banking site or request by phone, online from the support service. Transfer time can be up to three business days, but it is as reliable as possible. On holidays and weekends funds are not charged. But you can transfer large sums once. Much larger than when cashing on a card.

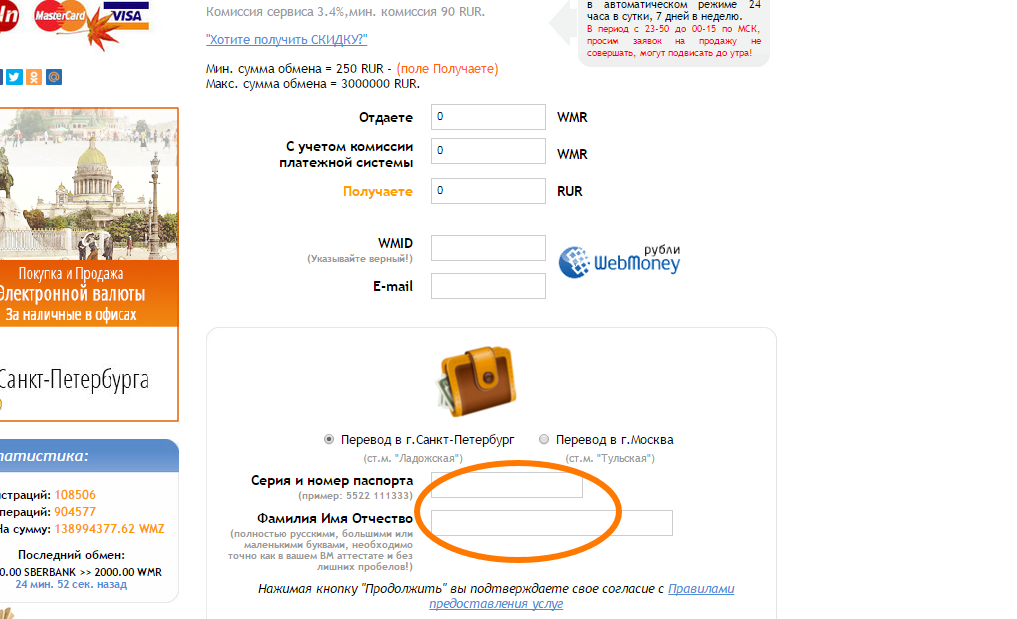

How to withdraw Webmoney rubles through a cash exchanger

Call 8 800 333 60 65 to agree on the receipt of funds: amount, time, place. Representative offices of the exchange center operate in St. Petersburg (metro station Ladozhskaya) and Moscow (metro station Tula), but courier delivery of cash can also be ordered.

Or fill out an application online: on the first page of the site, select the direction of the operation - p. Fill out the proposed data, after which you will be redirected to the Webmoney payment page. Having paid the application, you will be presented with a list of our offices. Please note that transfers to third parties are prohibited by WM. Full name in the certificate and the form of the recipient must match. It is possible to increase the maximum limits by prior arrangement with the manager.

How to send Webmoney by money transfer (PSD) in Russia and around the world

Chengmani customers can transfer VMs using without being tied to the registration address. In this case, the phone number, series, passport number, city are added in the form. Charges come within 12 hours. You can receive the transfer anywhere in Unistream, Western Union, Sberbank, Zolotaya Korona, at the post office of Russia, Contact, Anelik, Colibri (you can choose from different systems) with a passport, secret code.

From Webmoney to Yandex Money

Above, we examined how to transfer from WebMoney to a card. You can also transfer with WMZ, WME, or exchange for Qiwi. In the application write the amount, wallet numbers, email. The transfer will arrive after the confirmation of the operation.

Alternative options: how else can I cash out

Through Chengmani, it is possible to replenish Webmoney wallet without paying for the services of the service. There are no transactions with no withdrawal commission today. If you find an option without a commission, check ten times to see if the proposed scheme is definitely not fraudulent. Of the possible remaining methods:

- withdraw currency from your wallet through friends or look for intermediaries in forums, which is very risky;

- use the services inside the WM system (on the official website), which is problematic for beginners, and here you will also need to bind to a bank card.