In order to withdraw funds from a WMR purse to your bank account, a WebMoney system participant must have a certificate no lower than formal with verified personal data. The transfer fee is 15 rubles. plus a standard commission system. Duration: from one to five banking days.

The withdrawal procedure is performed on the Bank Transfer service and consists of several steps:

- formation of an application template for withdrawal of funds to the bank;

- checking by employees of the service Bank transfers of the details of the application;

- order and payment by bank transfer;

- setting the ability to order withdrawal of funds from WM Keeper.

Checking the application for withdrawal of funds to the bank is usually carried out during the working day and in the absence of errors in the details is carried out only once. After a successful operation, participants of the system have the opportunity of their WM Keeper to continue to submit an application for withdrawing funds directly from the application, without having to log in to the Bank Transfer service.

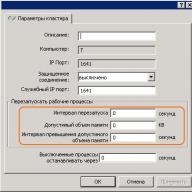

Before you start filling out an application, prepare the payment details and familiarize yourself with the rules for filling out an application and withdrawal limits. Then log in to the WebMoney Banking website and select the menu item Withdraw -\u003e R-Wallets. Then indicate "Bank transaction" and press the button "Forward".

If you have already sent the transfer before, select the saved template. If this is your first time applying for a withdrawal, then click "New details".

After selecting an item "New details" You will be asked in five steps to form an application for withdrawing funds by bank transfer.

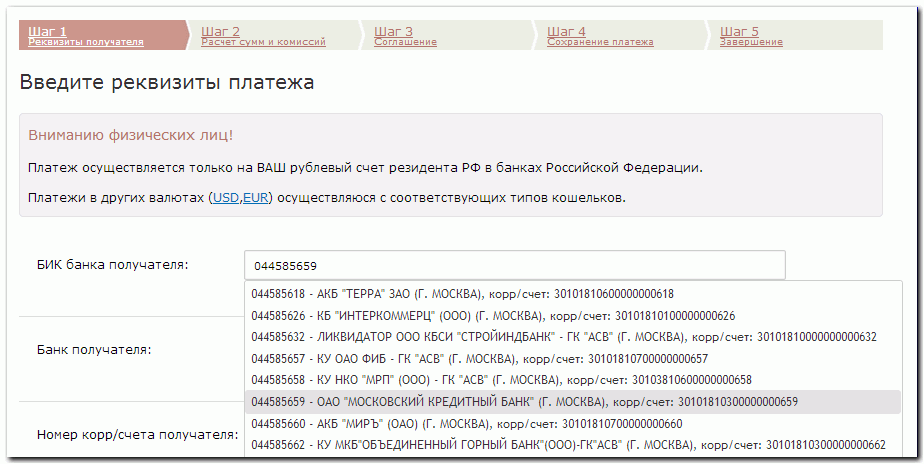

1 Enter manually the BIC of the beneficiary's bank. The service will automatically substitute the remaining bank details. From the list provided, select your bank.

The service will automatically fill in the application fields with your data from the certificate. After that, indicate the bank account number, if necessary, additional information in field "Purpose of payment" and press the button "Forward".

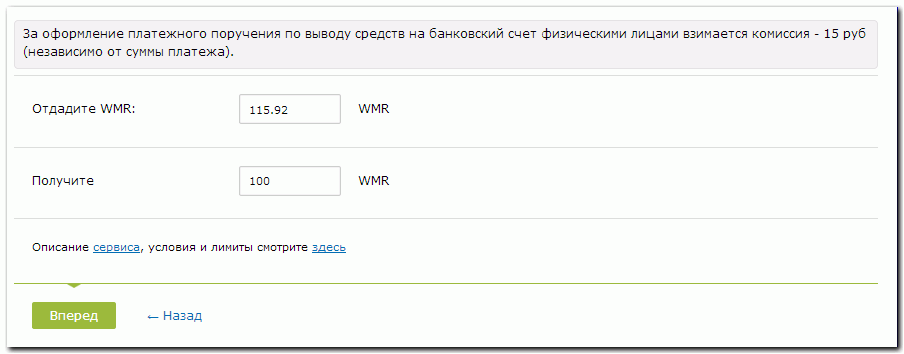

2 Next, enter the amount to be sent to the bank. Fill in the field "Get it", the system will automatically calculate the payment amount taking into account all fees (see field "Give WMR") Press button "Forward".

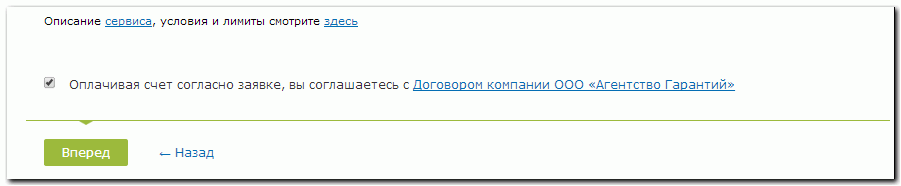

3 Read and accept the contract with the company that will transfer to your bank account, and click "Forward".

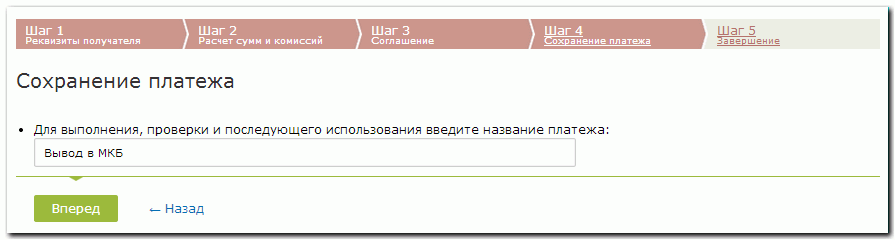

4 Enter a name under which the payment template will be saved on the service, and click "Forward".

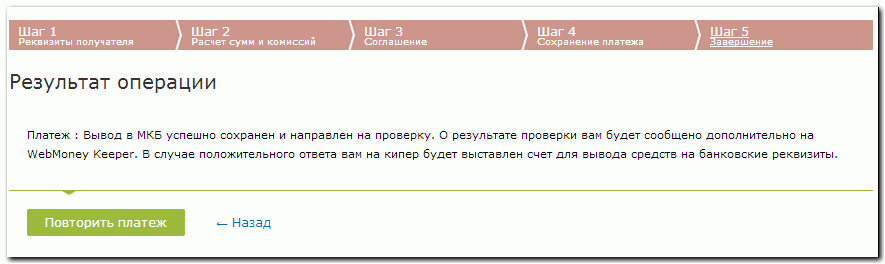

5 Make sure that the payment template is saved and sent for verification.

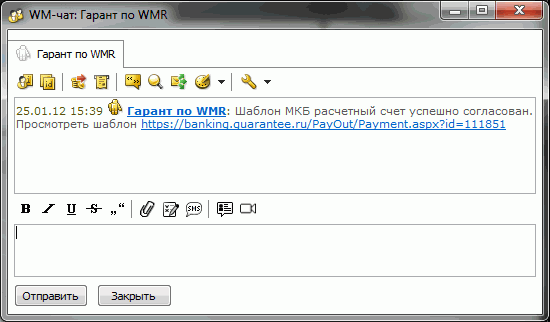

If the verification of your payment details was successful, then a message from the following service will be sent to your WebMoney Keeper.

At the same time, an invoice will be received to pay for the withdrawal request. Some time after paying the bill, the service will notify you of the bank transfer to your address.

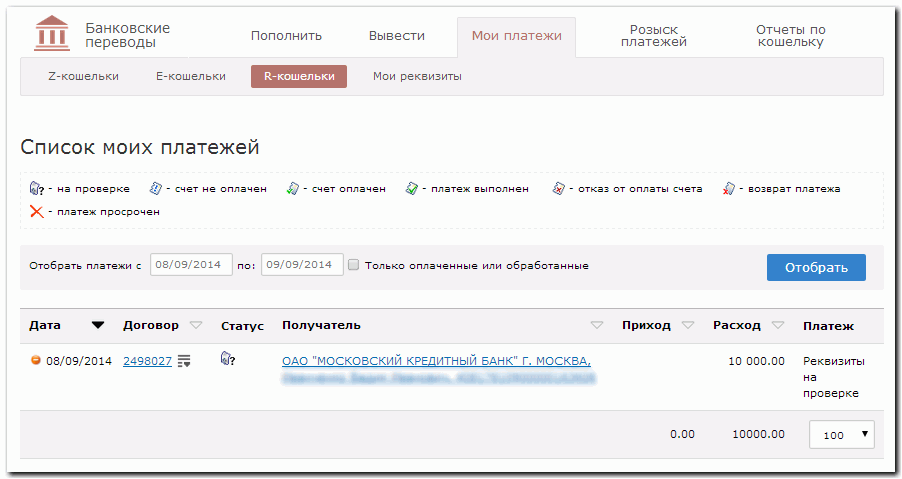

The status of the application can be monitored on the page My payments - R-wallets.

In the future, you will be able to withdraw your own funds to a verified bank account without agreeing on payment details.

You can configure the display of a bank account in the list of WM Keeper wallets on the My Payments-My Details tab. This page shows only successfully completed output operations. In order to enable the display, you need to in the graph "Show in WM Keeper" click link "Show".

1 date of crediting money (to a bank account)

2 date of crediting money to a bank account

3 credit funds to a bank account

credit money to a bank account

4 to your account

[PrepP; Invar]

1. Also: adv]

⇒ so as to be paid for by o.s.:

- (do sth.) at one "s own expense ;

- (pay for sth.) out of one "s own pocket ;

- (pay for sth.) o.s.

context transl

2. vacation to your account

5 to own account

[PrepP; Invar]

1. Also: TO YOUR ACCOUNT; FOR OWN ACCOUNT [ adv]

⇒ so as to be paid for by o.s.:

- (do sth.) at one "s own expense ;

- (pay for sth.) out of one "s own pocket ;

- (pay for sth.) o.s.

♦ This is monstrously unfair, Mazila says. I am an artist. My legal right to visit museums in France and Italy ... I want to go there at my own expense. I have not committed any crimes ... And they will not let me in (Zinoviev 1). "It" s monstrously unjust, "said Dauber." I am an artist. It is my legal right to visit museums in France and Italy. ... I want to travel at my own expense. I haven "t committed any crimes. ... And yet they won" t let me go "(1a).

♦ "I would invite a permanent carer at my own expense - they say to me, and this is impossible?" (Solzhenitsyn 10). "... I" dbe ready to pay for a permanent nurse out of my own pocket. But they tell me that "s not allowed either" (10a).

♦ This Ira somehow charmed the omnipotent Gridasova so that she provided her with a clean passport, dressed her from head to toe in clothes from her shoulder and sent them to the mainland at her own expense (Ginzburg 2). [ context transl] Ira had somehow cast such a spell on the omnipotent Gridasova that the latter had provided her with a perfectly clean passport, given her a complete set of clothing from her own wardrobe, and paid for her passage back to the mainland (2a).

2. vacation to own account

⇒ time off from work during which one does not receive pay:

- leave leave of absence without pay ;

- unpaid leave leave of absence ;

- leave of absence at one "s own expense.

♦ You have to be crazy to come to the personnel department at such a time and ask for leave at your own expense (Mikhailovskaya 1). One would have to be insane to ask for leave-without-pay right now (1a).

♦ Father took leave at his own expense and went with Kiley to Moscow (Nekrasov 1). Her father took a leave of absence at his own expense and accompanied Kilia to Moscow (1a).

6 on this account

TO THIS ACCOUNT (())

[PrepP; Invar; prep obj; fixed Wo]

⇒ with respect to the matter in question:

- on this (that) score (point, matter) ;

- concerning this (that, it, this matter etc) ;

- about this (that, it, this matter etc) ;

- in that regard.

♦ “The Information and Bibliography Department is my brainchild, and it should be the most beautiful. As long as it is headed by Mansurova, I have no concerns about this” (Zalygin 1). "The data and bibliography department is my baby and it" s got to be the most beautiful. As long as Mansurova "s in charge of it I" ve no worries on that score "(1a).

♦ He still lived with his parents and was not married yet. Mom wondered unsuccessfully on this score (Bits 2). He lived as before with his parents and was not yet married. Mama speculated on this point without success (2a).

♦ The Nazis hunted gypsies like they did game. I have never met anything official in this regard, but in Ukraine gypsies were subject to the same immediate destruction as the Jews (Kuznetsov 1). The fascists hunted Gypsies as if they were game. I have never come across anything official concerning this, yet in the Ukraine the Gypsies were subject to the same immediate extermination as the Jews (1a).

♦ "She is not to blame for anything! Nothing, can you tell me: what are you going to do with her now?" ““ Resolve calmly on this subject, Dmitry Fedorovich, ”the prosecutor replied immediately and with obvious haste,“ we have no significant motive to disturb the person you are so interested in at least something ”(Dostoevsky 1). "She is guilty of nothing, nothing! ... Won" t you, can "t you tell me what you" re going to do with her now? "" You can be decidedly reassured in that regard, Dmitri Fyodorovich, "the prosecutor replied at once, and with obvious haste. "So far we have no significant motives for troubling in any way the person in whom you are so interested" (1a).

♦ “You know, you said a rather curious thought; I’ll come home now and move my brains about this. I confess that I was expecting that you can learn something from you” (Dostoevsky 1). [ context transl] "You know, you" ve said a very interesting thought; I "ll set my mind to it when I get home. I admit, I did suspect it would be possible to learn something from you" (1a).

7 take on your account

[VP; subj: human or collect]

⇒ to perceive, interpret sth. (usu. a remark, inference, action etc o.s.:

- X took Y to apply to X;

8 take to your account

[VP; subj: human or collect]

⇒ to perceive, interpret sth. (usu. a remark, inference, action etc that may be offensive or unpleasant) as pertaining to o.s.:

- X took Y to apply to X;

- X thought Y was aimed at meant for, intended for him ;

- X thought Y was (done said) on his account.

♦ ... Neurasthenic said that Kies takes the caricature at his own expense in vain (Zinoviev 1). ... Neurasthenic said it was foolish to take the caricature personally (1a).

♦ He could not get rid of the loud cry stuck in his ears: "Shame!" - and could not forget the second when he accepted this scream at his own expense (Fedin 1). He could not get rid of that loud shout echoing in his ears: "Shame!" - and could not forget the moment when he had taken this shout to apply to him (1a).

♦ [City manager:] Of course, if he [the teacher] makes the student such a face, then it’s still nothing ... but ... if he does this to the visitor, it can be very bad: Mr. Auditor or someone else who can take it on his account (Gogol 4). Now, of course, if he makes faces like that at one of the boys, it doesn’t matter. ... But what if he should do the same thing to a visitor? It might lead to all sorts of very unfortunate consequences. The Government Inspector or some other official might think it was meant for him (4c).

♦ [Voynitsev:] Are you crying? [Sofia Egorovna:] Do not take these tears at your own expense! (Chekhov 1). You "re crying? Don" t think these tears are on your account (1a).

9

expenses charged to the operating account(e.g. to production account)

10 live on someone else's account

cadge verb:

sponge on(live on someone else's account)

sponge upon(live on someone else's account)

phrase:go on the bum(live on someone else's account)

11 charge

12 shunt

13 toadyism

14 pay in

15 on this account

16 form for depositing funds to the current account

paying-in slip

Deposit slip

17 the form to be filled in upon payment of the amount to the current account

deposit slip

deposit to current account - current account deposit

current account deposit - current account deposit

current account deposits - transferable deposits

current account deposits - transferable deposits

current account deposit - deposit on current account

In today's globalized world, the mobility of people and their money is rapidly increasing. A smaller percentage of those who live their whole lives in one place, in one country. Someone goes abroad to study, work, travel, someone starts his own business or works with partners in other countries. One way or another, very many are faced with the need to transfer money to a foreign account. However, this procedure has its pitfalls.

Firstly, there are several ways to transfer money to a foreign bank account. Depending on the specific situation, some of them may be the most profitable, while others may be completely unprofitable. And these methods should be estimated in advance so as not to encounter unnecessary losses of time and money.

Secondly, in recent years, Russians have faced particular difficulties in transferring money to a foreign account. On the one hand, there is currency control in the Russian Federation itself (all amounts over $ 5000 must be accompanied by certificates of the source of funds), on the other hand, foreign banks, who are afraid of sanctions because of communication with unreliable clients from Russia. Therefore, today, transferring money to a foreign account for a Russian is a difficult task, although feasible.

Ways to transfer money to a foreign account

You can transfer money abroad in various ways. It could be:

- transfer using electronic payment systems;

- transfer using international money transfer systems;

- cryptocurrency transfer;

- bank transfer.

Electronic payment systems for transferring funds to a foreign account

The most popular payment systems today are Webmoney, PayPal, Qiwi, Yandex.Money.

The most popular payment systems today are Webmoney, PayPal, Qiwi, Yandex.Money.

Money transfers using payment system attracted by its simplicity - they are carried out in a few minutes from anywhere in the world where an Internet connection is available. The most profitable transfers within the same payment system - in this case, the commission will be the smallest. However, in some cases, the transfer fee may reach 10%.

Data on transfers through electronic payment systems is protected by encoding. However, before using these systems, it is worthwhile to familiarize yourself with the rules for withdrawing funds, since often there are problems with cashing them out.

International money transfer systems to foreign bank accounts

Among the international money transfer systems, the most famous are Western Union, MoneyGram, Unistream, Golden Crown. The main advantage of these transfers is the ability to quickly and easily arrange the transfer of funds abroad, indicating only the recipient's data. Customer service points, such as Western Union, are located in almost every country in the world.

However, these systems may set their own conditions for the transfer of funds - including setting limits. In addition, the ability to send and receive funds is limited by the location and time of the customer service centers.

Transferring money to foreign bank accounts using cryptocurrencies

Cryptocurrencies are perhaps the most confidential way of transferring funds, but it is not very common due to public distrust. The most common cryptocurrency today is Bitcoin. Its value in recent years has been growing rapidly, and today exceeds the price.

To transfer money in cryptocurrency, you need a special electronic wallet. Using special cryptocurrency exchange platforms, you can transfer funds from a bank account or electronic wallet, from which the funds needed to purchase cryptocurrency will be debited. Then you can transfer, for which you need to specify the wallet number of the recipient.

Using cryptocurrencies, it is worthwhile to know in advance about the methods of withdrawing funds and possible legislative restrictions on the use of cryptocurrencies in the country where the funds are sent.

Bank transfers to replenish foreign accounts

Bank transfers include not only transactions from one bank account to another, but also operations to transfer funds from bank card to the account or vice versa - from account to card, as well as from one card to another. Each method has its own nuances.

To transfer money to a foreign account, you must have a bank account from which the amount is sent. For the operation “account-account” you will need to specify:

- Name and details of the sender's account;

- Name and details of the beneficiary's account;

- name and address of the recipient bank;

- amount and currency of the transfer.

Such a transfer may take quite long time - from 1 to 5 working days. In addition, you should carefully choose the time of the transfer - it is better to do this in the morning.

Money can be transferred to a foreign account either at a personal visit to a bank branch, or through the Internet banking system, which almost any bank offers today.

The bank charges a fee for transfers to a foreign account, but also provides a high level of security. If the details are incorrect, the money will remain in the account of the sender. You should also pay attention to whether the bank offers the “covered transfer” service, which exempts correspondent banks from paying commissions and ensures that the recipient receives exactly the amount that was sent.

Transferring funds from card to card is somewhat simpler, since it will be enough to indicate only the card number of the recipient. As a rule, in this case, the amount is credited to the account faster. When transferring from account to card or from card to account, the principle remains the same, only the bank account details are indicated instead of the card number.

Bank transfers in the systemSwift

The international SWIFT system allows you to make quick money transfers between banks in any currency of the world. To do this, the bank must be a member of this community (Community of Worldwide Interbank Financial Telecommunications), and it includes the vast majority of banks in the world, as well as the largest brokerage firms, exchanges, securities trading companies, central depositories.

The SWIFT system allows you to:

- transfer to a foreign account up to 5,000 USD or the equivalent of this amount in another currency without any accompanying documents;

- transfer to a foreign account an amount in excess of 5,000 USD or the equivalent in another currency, presenting a document substantiating: an invoice for study, hotel reservation, etc .;

- transfer any amount to a foreign account, proving the close relationship of the recipient - as a rule, providing a notarized certificate.

Individual banks may transfer any amounts of funds to a foreign account to a non-resident of the Russian Federation, subject to the availability of a document proving that the recipient is not a resident of the Russian Federation.

It is important to remember that each bank sets its own conditions for transfers to foreign accounts, so it is important to familiarize yourself with these conditions before opening an account with a bank. Significantly simplifies the process of transferring money to a foreign account if the sender himself has a foreign account. The main condition is the right choice of a reliable and stable bank with a good reputation, with which you can cooperate for many years. In order not to make a mistake with the choice, use our.

Transferring money to a foreign bank account: which way to choose? was last modified: May 18th, 2017 by Anastasija hramova

Help make our portal even more detailed, relevant and more useful for you and your business.

You are welcome, write a Question or Comment on the article!

Based on your valuable comments and questions for us, this article can be supplemented and improved.

ATTENTION! All posts containing hidden advertising, contacts and information not relevant to this publication will not be missed by the moderator of the portal for publication.

ATTENTION ONCE AGAIN: For specific individual questions and service orders, there is confidential chat, instant messengers, phone and our corporate e-mail. In comments we ask you to write exactly questions and suggestions for this particular article or your opinion on the issue that was raised in this article.